by Keith Gangl, CFA

Since the spring of 2022, investors have been dealing with consistently rising bond yields. This has occurred in conjunction with the Federal Reserve raising the Fed funds rate to slow the swift growth rate of inflation. Their intention is to slow economic activity enough to bring inflation back to the Fed’s target rate of 2%. Recently, however, a new surge in bond yields have left many investors puzzled by the sharp move higher.

The rising trajectory of interest rates, represented by the US 10 Year Treasury Yield1 (chart below), started to slow earlier in the year as investors anticipated the Federal Reserve was nearing the end of the tightening cycle. As inflation has continued to slow, rather than yields stabilizing, there has been a surge higher in 10-year Treasury rates (green arrow)1.

Investors have been grappling with higher rates, trying to determine their cause, and attempting to understand the implications of higher interest rates on both stock and bond markets. An easily identifiable catalyst for the timing of the rapid move higher is not perfectly clear, but there are several factors that could be driving rates higher:

- A strong economy (especially stronger than anticipated GDP growth)

- A robust job market that does not seem to be waning

- Greater bond issuance, resulting in an increase in supply

- Core inflation, while continuing to fall, remains above the Fed target of 2%

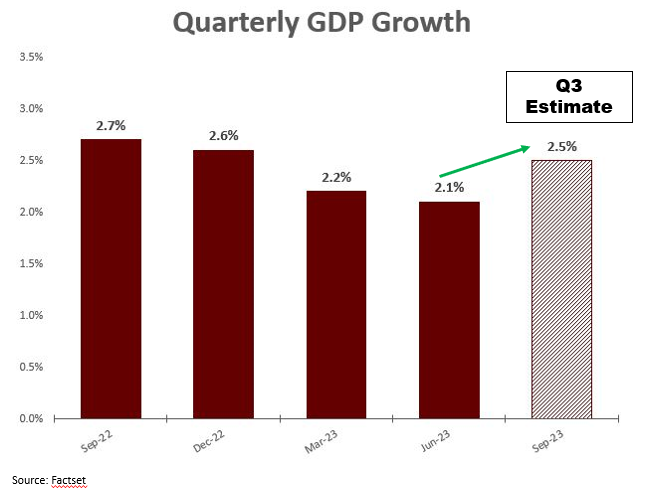

As a result of aggressive Fed actions, many economists were predicting a pending US recession (and one that potentially could have occurred already). The US economy, however, remains healthy despite the increase in interest rates over the last 18 months. A way to judge the health of the overall economy is the US GDP growth rate (chart below)2. GDP growth has been positive the over the last year, and there is little evidence of US recession that is either happening or will happen in the short term. A typical sign of a recession is a negative GDP growth rate, and the reality is the estimate for third quarter GDP is expected to accelerate from the previous quarter of 2.1% to 2.5%3.

Further, a healthy job market with an unemployment rate of 3.8%4 has the potential of keeping Inflation higher for longer as demand for workers results in higher wages. This is a headwind for the Federal Reserve’s goal of reducing inflation to their target level of 2%.

Another possible factor contributing to the surge in interest rates is the issuance of more bonds. Greater issuance increases overall supply, which then decreases bond prices and further drives up yields. The US Treasury announced earlier this summer it expects to borrow (issue) over $1 trillion5 in the third quarter which is higher than anticipated amount and would be the largest third quarter debt issuance in history.

High interest rates typically restrain the US economy, and this recent surge may cause the Fed to transition from a pause/hike every other FOMC meeting to a complete halt on raising rates. The recent surge in rates may have accomplished what the Fed was initially intending to do by raising rates.

The reason investors, and Gradient Investments as well, are keenly watching interest rates is because a rapidly increasing interest rate environment makes bond and equity investors nervous. Higher rates, and especially rapidly rising rates, are a headwind for companies and consumers alike due to higher and uncertain costs of borrowing to fund growth and spending. The good news with the recent surge in interest rates is the possibility of the Fed finishing their tightening cycle, which could lead to stabilization of rates without further damage to the economy.

With regard to higher rates, one positive is clear; higher rates, for savers, is a benefit. A higher interest rate provides investors the opportunity to earn a higher rate of return on safer assets, such as the Gradient Stable Value portfolio, than what was possible a few years ago. In the days of zero interest rates, savers had to resort to higher risk assets to achieve any sort of return. Now, with rates much higher, investors can allocate to both safer assets and growth assets to better balance risk and achieve appropriate levels of return.