There is much to consider when planning your retirement. With market fluctuations and economic downturns, it can be difficult to predict how much you need to last you through your retirement, and most people worry that they may not have enough saved.

When our clients come to us with these concerns, we identify three pillars that help make retirement plans more stable. First, we identify predictable income, such as a pension or Social Security. Next, we set up an investment strategy that hedges against market volatility. Finally, we ensure that the growth of our clients’ investments will outpace inflation and help prepare for the long haul.

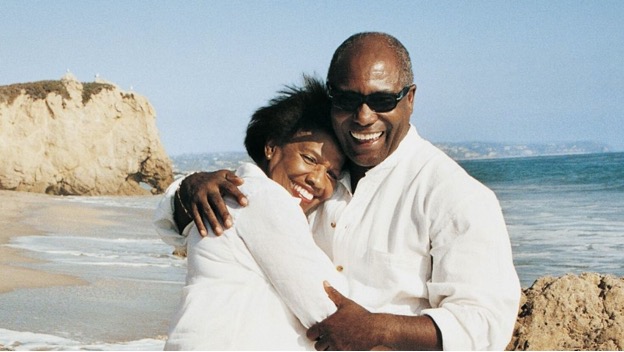

We used these three strategies to help one particular client, a couple, who came to us looking for help transitioning into retirement. They now feel secure in their retirement strategy and wealth management plan.

The Client

This couple, who was referred to us a few years ago, told us that they were within two years of retiring. They came to us looking for a plan that could help them transition out of the workplace and into retirement while maintaining the lifestyle they were accustomed to.

How We Helped

With this client, we identified their predictable income, which included Social Security and their pension plans. After that, we homed in on their investment strategy, making sure to diversify the investments so that it hedges against market volatility. Finally, we ensured that the investments would outpace inflation and they would be financially secure throughout their retirement.

With our help, this client was able to maximize their Social Security benefits as well as properly allocate their assets, which allowed them to have the peace of mind they needed in retirement. Along with the Social Security income, the couple’s pensions were also used to subsidize their income in retirement regardless of market fluctuations. In short, we were able to ensure our client’s success in retirement through the proper balance of invested money, which carries some risk, as well as safe money, such as their pensions and Social Security benefits.

Outcome

When we experienced some market volatility last year in March due to the COVID-19 pandemic, I reached out to this client to make sure that they were healthy, happy, and had no concerns about their wealth management strategy in their retirement. I also wanted to make sure that they knew they were still in good hands and to see if there was anything we could do for them during this particularly troubling period. They were pleased with my call and assured me that thanks to our plan, they had no worries about their retirement and could stay the course.

This client also wanted some assistance with their tax-planning strategy, as it is inevitable that we will experience increased taxes in the future. So, with our help and advice, they were able to set up Roth conversions to minimize their tax burden by putting them in the lower tax brackets.

Thinking About Retiring?

The bottom line: when it comes to retirement, you need a solid wealth management strategy that takes you through the transition from working to retirement smoothly and allows you to experience your retirement in the lifestyle that you are accustomed to. When working with clients, we take a holistic approach to their retirement, which includes proper diversification, the best tax strategies, Social Security maximization, and proper allocations of both investments and guaranteed income. Call us at (855) 756-5700 or email joe@aradvisorsinc.com to set up a complimentary introductory appointment.

About Joe

Joe Vitale is president and independent advisor representative at American Retirement Advisors, Inc. With over 30 years of experience in the financial industry, Joe specializes in wealth preservation and distribution, helping his clients protect their hard-earned money from market downturns and the cost of long-term care. As a fiduciary, Joe cares deeply about putting his clients first and serving their best interests. Joe resides in Lapeer County, where he is involved with and supports numerous local and national charities. He enjoys spending time with his friends and family, including his 5 daughters and 3 grandchildren. In his spare time you can find him relaxing in the country with his family or trying to better his golf game, which needs some help! To learn more about Joe, connect with him on LinkedIn.

By Joe Vitale